By Niket Nishant

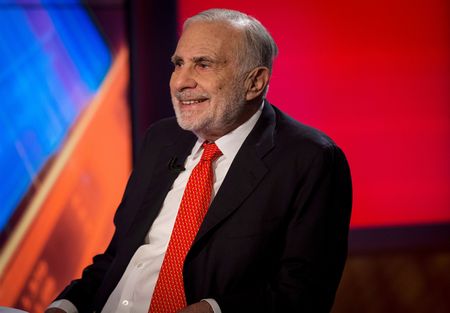

(Reuters) -Activist investor Carl Icahn’s eponymous firm cut its dividend in half on Friday, just a few months after a prominent short-seller went after the company’s payout structure that triggered a selling frenzy in its shares.

Icahn Enterprises shares closed 23% lower on Friday, and have shed more than half of their value since May 2 when Hindenburg Research accused the company of operating a “Ponzi-like” structure to pay dividends.

Icahn is one of the industry’s best-known activist investors, but has struggled to respond to Hindenburg’s challenges, calling its allegations “misleading.”

He has since restructured personal loans that required him to post collateral when the share price fell.

On Friday, he said in a letter that the investment holding company would refocus on activism, reducing unsuccessful bets that the stock market was due for a slump.

Meanwhile, Hindenburg said it remained short on IEP in a post on messaging platform X, formerly known as Twitter.

“Icahn Enterprises will eventually cut or eliminate its dividend entirely, barring a miracle turnaround in investment performance,” Hindenburg had said in May when it announced the short position.

IEP said on Friday it would distribute $1 per depositary unit to its investors for the second quarter, lower than its usual payout of $2 per unit.

It also disclosed that it was cooperating with a division of enforcement of the U.S. Securities and Exchange Commission (SEC)that had contacted in June for information on the company and certain of its affiliates.

Neither the U.S. Attorney’s office nor the SEC has made any claims or allegations against IEP or Icahn with respect to the foregoing inquiries, the company said.

It said losses widened to $269 million, or 72 cents per depositary unit, for the quarter. It lost $128 million, or 41 cents per unit, a year earlier.

Shares fell as low as $20.54 during the session on Friday, hitting their lowest in over two months. Icahn has denied the allegations and has vowed to “fight back” against the short seller’s report.

“We do not intend to let a misleading Hindenburg report interfere with this practice (of distributing dividends),” Icahn Enterprises said on Friday.

In a letter to investors, Icahn touted his firm’s decision to reset its focus on its core activism strategy, and said it had “significantly” reduced hedges over the past six months.

“Our returns have been overwhelmed by our overly bearish view of the market and related oversized short (hedge) positions,” the 87-year-old billionaire investor wrote.

Icahn last month said he had restructured $3.7 billion in personal loans to remove a link between his obligation to post collateral and his holding company’s share price.

After Hindenburg published its report in May, IEP said in a regulatory filing that the U.S. Attorney’s Office for the Southern District of New York was investigating the company.

It is not clear whether the scrutiny from federal regulators was related to Hindenburg’s allegations. The company has provided no update since then.

(Reporting by Niket Nishant in Bengaluru; Additional reporting by Manya Saini; Editing by David Gaffen, Milla Nissi and Sriraj Kalluvila)